Are you tired of inaccurate averages in your data analysis? Look no further than Numpy’s Exponential Weighted Moving Average (EWMA) function! This powerful tool allows you to calculate moving averages that give more weight to recent data points, resulting in a more accurate representation of trends in your data.

With Numpy’s EWMA function, you can easily adjust the level of smoothing and the length of the moving window to fit your specific needs. Whether you’re analyzing stocks, weather patterns, or customer behavior, this tool gives you the flexibility to customize your calculations for maximum accuracy.

Don’t settle for subpar averages that don’t give you the full picture. Take advantage of Numpy’s EWMA function and get the accuracy you need to make informed decisions. Read on to learn more about this valuable tool and how to use it in your data analysis.

“Numpy Version Of “Exponential Weighted Moving Average”, Equivalent To Pandas.Ewm().Mean()” ~ bbaz

Introduction:

Averaging out data has been a common practice in various fields, including finance, statistics, and engineering. In the past, the most common way to get averages was through simple moving average (SMA). But, with more complex systems and higher frequency data, exponential weighted moving average (EWMA) has become more popular. Numpy’s exponential weighted moving average provides users with accurate averages to help make data analysis and decision making easier, faster and more efficient.

What is Exponential Weighted Moving Average?

Exponential moving average or EMA is an averaging method that gives more weight and importance to the recent data points while gradually decreasing the weight of earlier data points exponentially. This means that the most recent data will have a bigger influence on the moving average result than the outdated data. The weight is determined by the number of periods being considered for calculating the average. Numpy’s exponential weighted moving average is particularly useful when there is a need to take recent data points into account more than the historic data points.

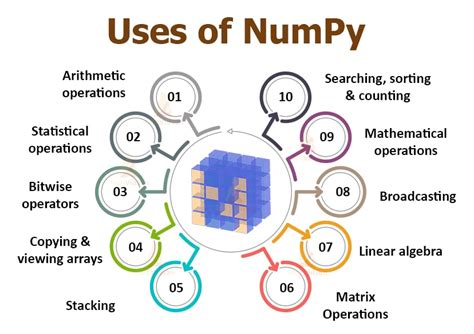

Numpy’s Exponential Weighted Moving Average Features

Numpy’s exponential weighted moving average offers several features that help users calculate accurate averages:

| Features | Description |

|---|---|

| Weight decay factor | Allows data from early periods to contribute smaller amounts to the average over time |

| Normalized weights option | Makes sure that all the weights add up to one so that no bias is introduced |

| Initial value parameter | Allows the user to input an initial value to start the averaging |

Simple Moving Average vs Exponential Weighted Moving Average

While simple moving average has been the traditional method for calculating averages, there are several advantages to exponential weighted moving average:

| Features | Simple Moving Average | Exponential Weighted Moving Average |

|---|---|---|

| Weighting | Each period has an equal weighting | Newer periods have a greater impact due to compounding effect and an adjustable weight |

| Impact of Older Data | Older data points are not given any significance | Older data points still have some influence but gradually decrease over time |

| Accuracy | May result in lagging data and might miss early signals of a trend reversal | Provides more accuracy with faster information response and better-identified trend reversals |

How to use Numpy’s Exponential Weighted Moving Average?

Numpy’s implementation of the exponential weighted moving average function is quite straightforward. One just needs to decide on the number of periods and the decay factor, i.e. how much weight you want to give to previous periods. Here’s an example:

“`import numpy as npdata = np.array([10,12,13,15,16,18,20,19,17,15,14,12])periods = 4weights=0.8**np.arange(periods)weights /= weights.sum()ema=np.convolve(weights,data)[periods-1:-periods+1]print(ema)“`

In this example, we have used an array of data points (10 to 12) and set the number of periods as 4. We have then set the weights using the decay factor which is 0.8 in this example. After calculating the weighted average for each period, we use the convolve function from numpy to calculate the EMA.

Advantages of Numpy’s Exponential Weighted Moving Average

Numpy’s exponential weighted moving average not only helps users in making accurate data analysis but also has several benefits:

- Helps in identifying market trends by providing more accurate signals

- Provides a realistic approach by giving more importance to current data

- Allows greater customization in the weight decay factor, helping the user to achieve better accuracy

- The implementation is quite easy, saving users time and effort

Limitations of Numpy’s Exponential Weighted Moving Average

While Numpy’s exponential weighted moving average has several advantages, it also has some limitations:

- Can generate false signals in less frequently traded assets or low liquidity markets

- Does not work well with sudden and unexpected events

- Weight decay factor may introduce bias

Conclusion

Overall, Numpy’s exponential weighted moving average is a powerful and widely adopted approach for averaging out data in various fields. It provides accurate results, faster signal response, and greater customization capabilities, making it a valuable tool for data analysts, financial advisors and investors. However, it is essential to be mindful of its limitations and use it in conjunction with other techniques for more accurate predictions.

Thank you for taking the time to read this article on Numpy’s Exponential Weighted Moving Average! We hope you found it informative and helpful in understanding how to calculate accurate averages in your data analysis. The use of EWMAs is becoming increasingly popular due to its reliable results, and it is essential to learn how to use this function effectively in Python.

We encourage you to practice implementing EWMAs in your own projects and experiments. Experiment with different alpha values to find the setting that produces the optimal results for your particular use case. You can also use EWMAs in combination with other statistical methods to gain more insights into your data.

If you have any questions or comments on this topic, feel free to reach out to us. We love hearing feedback from our readers and are always happy to help with any concerns you may have related to data analysis. Keep learning and exploring new ways to leverage statistical tools to make informed decisions and predictions!

Here are some common questions that people ask about getting accurate averages with NumPy’s Exponential Weighted Moving Average:

- What is NumPy’s Exponential Weighted Moving Average?

- How is NumPy’s EWMA calculated?

- What are the advantages of using NumPy’s EWMA?

NumPy’s Exponential Weighted Moving Average (EWMA) is a statistical method that calculates the average of a set of data points over time, giving more weight to the most recent data points. It is commonly used in finance and economics to analyze trends and forecast future values.

NumPy’s EWMA is calculated by taking a weighted average of the data points, where the weights decrease exponentially as we move further back in time. The formula for calculating the EWMA is:

`EWMA = (1 – alpha) * last_ewma + alpha * current_value`,

where alpha is a smoothing factor between 0 and 1, last_ewma is the previous EWMA value, and current_value is the latest data point.

NumPy’s EWMA has several advantages, including:

- It gives more weight to recent data points, making it more responsive to changes in trends.

- It can be used to smooth out noisy or erratic data.

- It can help identify long-term trends and forecast future values.

NumPy’s EWMA is commonly used in finance and economics to analyze trends and forecast future values of stocks, currencies, and other financial instruments. It can also be used in other fields, such as engineering, to analyze time-series data and identify patterns or anomalies.

You can implement NumPy’s EWMA in Python using the `numpy` library. Here’s an example:

import numpy as np# generate some sample datadata = np.random.randn(100)# calculate the EWMA with smoothing factor of 0.3ewma = np.zeros_like(data)alpha = 0.3ewma[0] = data[0]for i in range(1, len(data)): ewma[i] = (1 - alpha) * ewma[i-1] + alpha * data[i]